With Quantum Opredex, people can do away with the stressful search for investment education. The website assigns suitable educators to users for free. Quantum Opredex is accessible to anyone willing to register for investment education.

People anticipating to connect and begin their investment classes can sign up on Quantum Opredex. Registering on Quantum Opredex only requires submitting names, email addresses, and phone numbers in the sign-up form. Quantum Opredex will connect people with schools after registering. A representative from each school will contact each user to share more information with them.

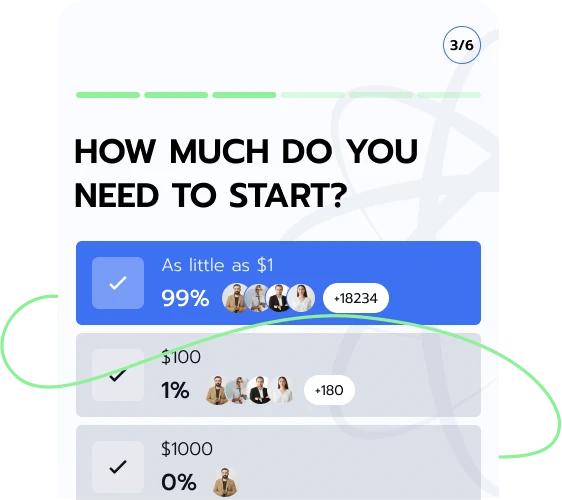

The internet is populated with many institutions training people to become investors. However, many of these have content that’s either too advanced for the average beginner or too weak for the seasoned investor. Quantum Opredex, therefore, makes it so that each user finds a suitable match. Beginners and experts alike are welcome. Register on Quantum Opredex to connect with a suitable investment education firm.

The investment information Quantum Opredex shares is insufficient. It only aims to introduce people to investment. For comprehensive lessons, Quantum Opredex connects people with investment education firms.

These firms teach all investment courses thoroughly and answer students’ questions. Register on Quantum Opredex to connect with an investment teaching firm.

Quantum Opredex collaborates with suitable investment education firms worldwide. We take note of the user’s desired language and set them up to learn to invest. No one is left out this way.

For Quantum Opredex, it’s all about reaching people and helping them make sense of investment complexities. Connect with an investment school by signing up on Quantum Opredex.

Quantum Opredex connects people with investment education firms to gain comprehensive and precise investment knowledge. Register on Quantum Opredex to connect.

People who use Quantum Opredex and go on to learn all they need about finance may use their newfound skills in their careers and pursue their goals. If this sounds desirable, why not connect with investment teachers on Quantum Opredex?

Many are oblivious to economic operations and changes. Quantum Opredex intends to change this for those who are enthusiastic about learning. Get an understanding of the economy by registering on Quantum Opredex.

These risks are broadly categorized as systematic and unsystematic. Systematic risks are uncontrollable, affecting the entire market through recession, inflation, war, and disasters. Unsystematic risks are specific to certain businesses and are influenced by failure to do due diligence and poor governance. Register on Quantum Opredex to learn more from investment education companies.

Retail investors buy and sell securities without intermediaries. These investors enter financial markets through online training platforms, exchange-traded funds, individual stocks, and brokerage accounts. On the contrary, institutional investors pool funds from many investors to invest in different financial instruments. Quantum Opredex outlines a few human-related investment terms:

An issuer (debtor) develops, registers, and sells securities to investors. Legal entities that issue securities include credit unions, companies, credit card issuers, banks, and states. Investors (creditors) usually consider issuers’ creditworthiness, liquidity risk, default risk, and volatility before choosing them. Learn more by signing up on Quantum Opredex.

This individual or company acts as a middleman between a security exchange and an investor. As an intermediary, a broker handles the buying and selling of securities between both parties and charges them a commission. To learn more about brokers from investment education companies, register on Quantum Opredex.

Bondholder

They acquire bonds issued by governments or corporations. Sign up on Quantum Opredex for more information.

Investment Analyst

This financial professional evaluates investment and financial information. Register on Quantum Opredex to get more details from investment teachers.

Shareholder

This person or company possesses a share of a mutual fund or a company’s stock.

Being a shareholder may come with several rights. These include voting on corporate matters, claiming a portion of a company’s gains after liquidating its assets, receiving dividends, and inspecting its records. Learn more about shareholders by signing up on Quantum Opredex.

They offer small companies or startups capital for an equity stake. Types of venture capital are seed, early-stage, startup, expansion, and late-stage capital. Venture capitalists may also offer founders mentorship and help them network, but they may prioritize their financial interests over a company’s success. Want to learn more? Register on Quantum Opredex.

The common cash metrics are liquidity, capital expenditures, net present value, cash flow per share, cash conversion ratio, dividend payments, internal rate of return, funding gap, price-to-cash flow ratio, and cash flow yield. Liquidity evaluates how well or fast a company can convert its assets to cash to meet financial needs, while capital expenditures may fund reinvestment and business development. Net present value calculates a business’ value by measuring the difference between its present cash inflow and outflow values over a period.

Cash flow per share is measured by dividing the cash from operating activities by the number of outstanding shares. The cash conversion ratio is the time between when a company pays for its COGS and when it receives payments from its customers. Get more information about cash flow by registering on Quantum Opredex.

An income statement is a financial report tracking a company’s revenue, gains, expenses, and losses. The report shares information about a company’s operations, efficiency, and health. Managements use income statements to understand a business’ performance and make decisions regarding buying and selling capital assets, expanding into a new sector or geographic location, and expanding production capacity.

Investors use income statements to assess a company’s activities and viability. On the other hand, creditors use this financial report to determine a company’s future cash flow. Another important factor to consider as we discuss the income statement is the gains margin, which measures the extent to which a company makes money. Quantum Opredex discusses the four types below:

This shows how efficiently a business can make returns from its core operations. It is derived by dividing operating earnings by revenue. Companies can have high or low margins. High-margin companies may make sales without spending heavily on development and marketing. Companies that spend on resources that aid their operations may have low margins. Register on Quantum Opredex to learn more.

It measures a company’s gains as a percentage of its revenue. Net margin includes all factors in a company’s operations. These factors are COGS and other operational expenses, one-time payments for unplanned events, additional income streams, total revenue, corporate tax expenses, interest expense on debt obligations, and investment income. For more details, register on Quantum Opredex.

This measures a company’s efficiency and operational viability and assesses organic growth. It is measured by dividing earnings before taxes (EBT) by revenue. While the pretax margin can measure business efficiency, it must still be used with other metrics for more comprehensive results. Learn more about pretax margin from investment teachers by registering on Quantum Opredex.

It analyzes a company’s financial health. In other words, the ratio determines a company’s performance by comparing its gross margin and revenue. It is calculated by subtracting a company’s COGS from its net sales and dividing the result by the net sales. To learn more, register on Quantum Opredex.

Some ways for companies to determine their target payout ratio are identifying their optimal capital budget and determining the amount of equity to finance the capital budget. Also, they may meet payment obligations with retained earnings and pay shareholders with available residual earnings after supporting optimal capital budget needs. For more information, register on Quantum Opredex.

Parties involved in loan syndication include borrowers, lead arrangers, syndicates of lenders, and agent banks. Borrowers are corporations or governments seeking financing. The lead arrangers structure the syndicated loans, form the syndicate of lenders, and facilitate the loans between borrowers and lenders.

The syndicate of lenders - banks, investors, and other financial institutions - provides the loan, while agent banks are the administrative personnel. This party oversees loan disbursement, repayment, and communication between borrowers and lenders. Want more information? Sign up on Quantum Opredex.

A reverse stock split consolidates existing shares of stock into fewer and higher-priced shares. A company divides its existing total shares by a number or particular ratio to do this. So, if a company divides its total shares by 5, it has 1-for-5. This ratio shows that an investor will receive one share of every five shares they own. This method may help companies improve share price and maintain it after a spinoff. To learn more, register on Quantum Opredex.

This is a share of gains paid to a shareholder or company owner. For more information, register on Quantum Opredex.

It is what a person may earn from investing in an asset or lending money. To learn more, register on Quantum Opredex.

This is the method for evaluating an asset’s intrinsic value and price-influencing factors. Sign up on Quantum Opredex for more.

It is the failure of an investment to yield returns or a partial reduction in the expected returns on an investment. Get more details by registering on Quantum Opredex.

They are trained to advise clients on financial or investment matters. Register on Quantum Opredex to learn more about financial advisors from investment tutors.

It is a money-related liquid asset. To learn more about cash and cash equivalents, register on Quantum Opredex.

By registering on Quantum Opredex, people can meet investment tutors within minutes and begin a smooth journey to financial literacy. Become an investment student by signing up on Quantum Opredex.

| 🤖 Registration Cost | Free |

| 💰 Fees | No Fees |

| 📋 Registration | Simple, quick |

| 📊 Education Focus | Cryptocurrencies, Forex, Mutual Funds, and Other Investments |

| 🌎 Supported Countries | Most countries Except USA |